So, you want to strike out on your own, and start your own business? Great! Here are a few things you might want to know about that. They are based on my own experience as an independent contractor (computer programmer), what I've seen being married to an owner (with a partner) of a small retail shop, and what I've seen and heard talking to multiple small business owners of various kinds in the last twenty years. Some of them are successful, some of them were not, and some were successful but didn't like it, and stopped. The recurring thing I've seen (and my own lived experience) is that owning and running your own business is not what most people think it is like, so perhaps this will be useful to you as you set out on a different path.

The most important thing to know, is that being a business owner is NOT like being an employee, except without the boss. This is, I think, the number one misconception that most people have. In fact, not only do you still have a boss, but your boss:

Your boss is, of course, the market. New small business owners (and even old ones, sometimes) think they get to decide when they will work, and therefore that customers will show up when they want them to. But in practice, customers show up when THEY want to, and you need to be ready for them. If you are not, generally speaking, they will go elsewhere or just forego spending entirely. The same logic applies to all of the rest of the items in the list above. The market does all of this, and it is up to you to figure it out, because it won't tell you ahead of time.

Which means really, you have to figure out the rules, and impose them on yourself. So, when owning your own business, it is not as if you no longer have a boss who makes you do stuff you don't want to do. It's more like, you also have to be that boss, forcing yourself to do things you don't feel like doing, because there isn't anyone else there to tell you to do it. That's what "being your own boss" really means; it's not the same as not having a boss. If you aren't able to make yourself do things when they need doing, even though you don't feel like it right then, then being your own boss may not be for you.

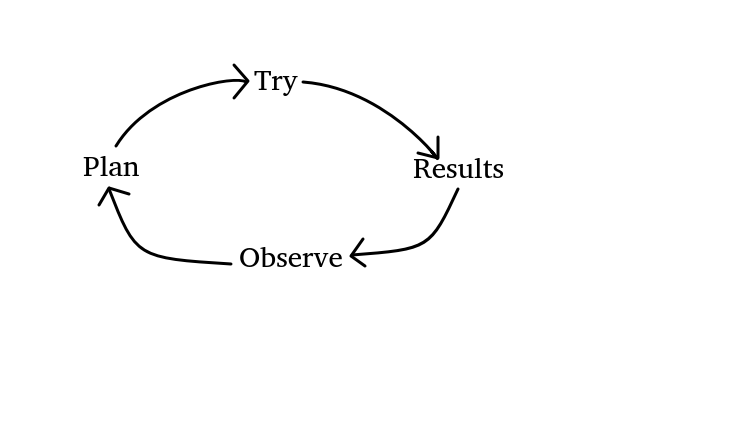

There is a process, which you need to know about and think about, as you run a small business. It is a loop, which can be divided into four parts:

It may seem so simple and straightforward, that there's no point in stating it. But, most business failures can be traced ultimately to one of the following breaks in the loop:

Let's look at each of these failures in more detail.

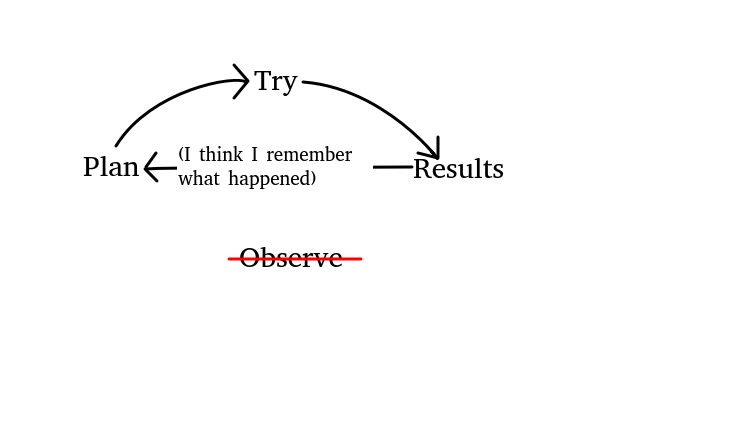

Part of this, is the common conception that keeping a lot of data about what happened is a drag, and only corporate losers do that sort of thing and starting your own business is all about getting away from that. Part of it is a failure to understand (per Lesson 1: You Still Have A Boss) that having your own business doesn't mean you get to do whatever you want. One example I've often seen, is in the decision of what hours a day, and what days of the week, to be open.

Now, it is certainly true that you have the right to close your store whenever you want to. Perhaps you don't want to be open on Sundays, because your religious beliefs prohibit it. It's your life. More typically, though, people just sort of don't want to be open on Sundays, but don't want to pay any penalty for this. Therefore, they convince themselves that nobody shops on Sundays anyway. This is, essentially, trying to get out of working on Sundays, without letting your boss see you doing it and docking your pay. This is employee-type thinking. Once you are a business owner, not an employee, this way of thinking makes no sense anymore. If you want to know the cost of not being open on Sundays, you need to collect some data. For example, you can keep your store open 7 days a week at the beginning, and keep track of how much your sales are each day. If you do, you will probably find that, just as you want to do a good bit of your shopping on Sunday, so do your (potential) customers. Sunday is not quite as busy as Saturday, but probably it is more busy than, say, Monday or Tuesday.

But, the lesson is NOT that you should be open on Sundays. The lesson is that you should not take my word for it, or your own intuition; you should keep track of exactly what happens when you do stay open on Sundays, and look at the cold, hard, unfeeling, pitiless numbers in a spreadsheet before you decide that it's not worth staying open on Sunday. Of course, if it's a religious thing, or you just don't care about making money, or for whatever other reason you decide to close on Sundays anyway, that is entirely up to you. But DON'T fail to collect the data. Don't make decisions based only on your intuition, because when you do that it's the equivalent of the boss asking his employees, "I dunno, should we be open on Sundays?". What they tell him is based on what they want, not what's good for the business. You are the boss, and your intuition is like the employees here. Your intuition will tell you what it wants to be true. Keep track, numerically, in a spreadsheet, of what happened. That's what tells you what really is true.

The same logic applies to having a 25% off sale, having a special event at your business, selling a new product, and so forth. It's your decision, but fortify yourself against wishful thinking by keeping careful, numerical, track of what happened. You should have, in a spreadsheet, a record of what happened at this time last week, last month, last year. If sales are slow, is this because they always are slow this time of year? Or this day of the week? Or is there something new going on, that you need to look into? If you spent money to get a new kind of merchandise in your store, how much did you pay for it, and how much did it sell for? How much do you spend on things, and how much of that goes to waste? You should know, and you should not rely on your memory or your intuitive hunch. Put it in a spreadsheet, and look at it. When it comes time to pay the bills, the bank's computer will take a cold, hard, pitiless look at how much money is in your bank account. Therefore, you need to be taking a cold, hard, pitiless look at what is working, and what isn't, so that you will be able to pay those bills.

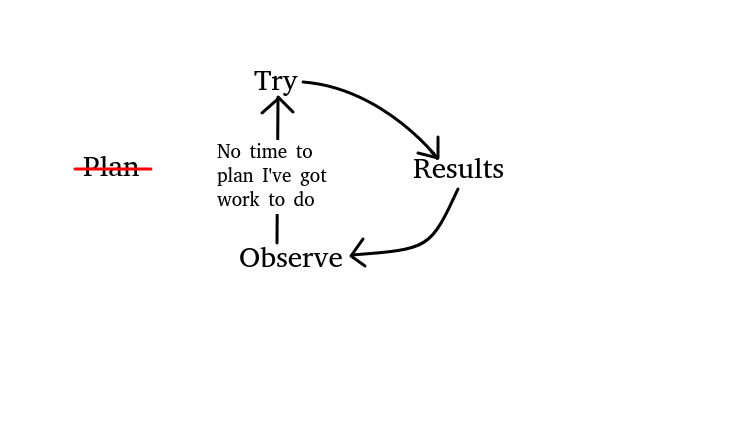

Let's assume, for the moment, that you have a decent work ethic. You're willing to hustle to get things done. This is mostly a good thing, but there is one case where it can get you into trouble, and that's when you're not willing to pause, and plan, because there's so much work to do and you want to get started. Many times, there are more things that need doing, than there is time to get it all done. It may seem like this means you need to hustle more. In fact, it means you need to stop hustling, at least for a little while, and think carefully about what needs to be done first.

Once again,this may mean you end up acting a little like those boring loser corporations that you were wanting to get away from when you decided to start your own business. Planning, to some people, is boring and seems pointless because nothing gets actually accomplished. But you don't have enough time, energy, and money to do everything you can think of that needs doing. When you have your own business, you NEVER run out of things that need doing. This means you need to carefully plan, and prioritize, so that what you actually do is what is most likely to help. Just because you are working hard, doesn't mean you are doing what is most important right then. Make a list of all the things that need doing, put them in an order from highest priority to lowest, and start from the top. Don't work on the first thing you happen to see that needs doing. Work on the thing at the top of the list of priorities, and leave some time in your schedule for making sure that list is right. Is the thing at the top more important than what is below it? If you cannot get everything done, is the stuff at the top of your list what you would choose to do? Or will you discover that you have been sprinting nonstop for weeks and much of what you did turned out to be pointless, because (for example) you spent a lot of time painting the great looking sign for your bakery's special Easter sidewalk sale, but never got the permit from the city to have a sidewalk sale so you cannot do that, and the time spent on painting that sign is wasted. Work on the most necessary things first, and realize that not everything you can think of, will get done. Even though stopping to plan takes away some of your (already insufficient) time, it also helps increase the odds that you are spending your time wisely, and not wasting it.

All of the above discussion about prioritizing your time, also applies to prioritizing your money. You will run out of money, if you spend it on anything that seems like a good idea. There are absolutely more sensible-sounding, good ideas to spend your money on, than you have money. So prioritize. You cannot run your business, if you don't pay rent. You cannot run your business, if you don't pay for electricity. Advertising or a snazzy sign might be a good idea, but if you get locked out by your landlord or your electricity gets turned off, that snazzy sign is doing you no good. So put aside money for rent, utilities, etc. before you spend anything on stuff that, however important it may sound, is not going to matter if the necessities don't get covered.

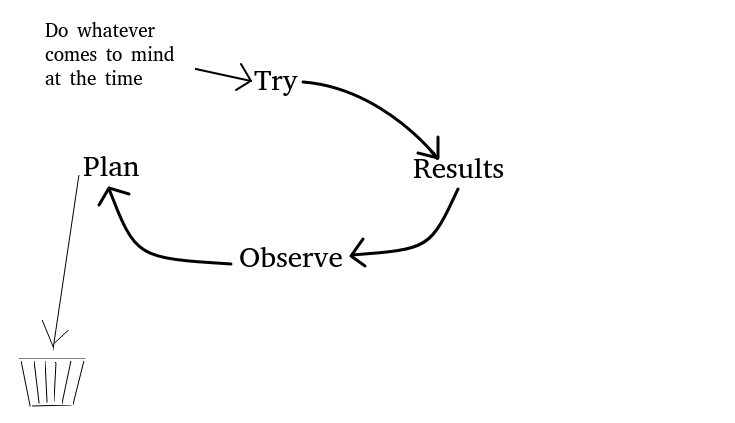

So, for every person who has the flaw of a great work ethic that gets in the way of planning, there is probably another person who has the opposite problem of planning more than doing (the daydreamer). But even more pervasive, is the problem of "planning" and "doing" having nothing much to do with one another.

For sure, sometimes things change, and the plan needs to change with it. But more commonly, once the planning stops and the doing starts, the plan is more or less ignored. It is almost as if the planning and doing are carried on by entirely different parts of the brain. Which, I'm no neuroscientist, maybe they are. But regardless, in order for the planning to help, in other words in order for the business to get better and better over time, the plan needs to actually impact what gets done.

The best way to encourage this to happen, is to make the plan simple enough. The best plan is a simple list of things to do, in the priority in which they should be done, and don't start doing item 2 until item 1 is done. Usually, it's not going to be possible to do everything absolutely in numerical order all the time, but at least don't do anything way down the list unless the items in the top few spots are done first.

Sometimes, a more complex plan than a simple priority list is required. You may use a calendar, you may use a (simple, free) piece of software that reminds you of that thing you need to do a month from now, which you cannot start now but must not forget to do. However you do it, you have to actually use the list, software, or calendar. If you notice that your plan keeps getting ignored, you may need to change from a calendar software (that you never remember to open and look at) to a physical calendar (that is right there on the table looking up at you, so you can't forget it). Or, you may find that a paper calendar gets ignored, and software on your computer that pops up and gets your attention works better for you. The one thing you must do is find a way to not only plan, but do what you planned.

What no piece of software, or calendar, or any other device is going to do for you, is provide the willpower to actually do what you planned, instead of whatever appeals to you most at that moment. You have to be your own boss, which means instead of having a jerk boss tell you that you have to do the un-fun thing now, you not only have to do that un-fun thing, you also have to be the jerk who says to do it. That's what it means to be your own boss. You still have a jerk for a boss, you just have to also be that jerk.

So, now that we understand how "the loop" works, we can talk about why debt is usually a bad idea. I have seen numerous small businesses die because they took on a big business loan early. You probably think I'm going to say debt is bad because of the interest, but that's not actually the worst thing about it; even a zero-interest loan can kill your business. The reason why, is related to how "the loop" works.

When people start a business, they think they already know most of what they need to, about how to run that business. Restaurant owners just starting out, may believe that because they know how to cook good food, and what an enjoyable restaurant experience is like, they know what they need to know to run a restaurant successfully. New bar owners may think that because they know a lot about alcohol and having fun at the bar, they know how to spend their money wisely in running a bar. They are wrong.

Each time you go around "the loop", you get a little bit smarter about how to spend your money. That's why the "observe" and "plan" parts are so important; they involve not just doing the same thing again and again, but using what just happened as a little lesson in what works, and what doesn't, so that your next time around that loop, you can do a little bit better because you're a little bit wiser about what works.

When you get a big business loan, though, you are doing all of your spending up front, then getting all your results, and learning about what worked when it's too late to use that knowledge. In other words, YOU DO ALL YOUR SPENDING BEFORE YOU DO ANY OF YOUR LEARNING. It's a great way to make sure you spend your money in the wrong way. Let's unpack that idea a little more.

If you did not have a loan, we could imagine that you start with only $1000, and you spend it (picking, for example, what products to have at your store, or what places to advertise your services, or etc.). You're new at this, and it doesn't go as well as you hoped. In fact, you only make $900 after spending $1,000. You actually lost money. You take your $900 and you spend it on slightly different products, advertise in different ways, or whatever lessons you've learned. This time, you break even, and get back your $900. Still not great, but you've learned some more lessons, and you make some more changes when you spend that $900 the third time around "the Loop" that we talked about above. You actually make a profit! It's a tiny profit; 10%. You now have $999. You don't give up, and you observe carefully what worked and what didn't, and you make a slightly different plan, and you keep incrementally improving. Here's what it would look like, where each row is one time around that "Try-Result-Observe-Plan" loop.

| Money spent | Money received | Profit |

|---|---|---|

| $1,000 | $900 | -10% |

| $900 | $900 | 0% |

| $900 | $990 | 10% |

| $990 | $1,188 | 20% |

| $1,188 | $1,544 | 30% |

| Net profit | ||

| $544 |

So, what would it have looked like, if you'd taken out a $5,000 loan instead? It would have looked like this:

| Your money | Owed | Money spent | Money received | Profit |

|---|---|---|---|---|

| $1,000 | $4,000 | $5,000 | $4,500 | -10% |

| Net profit | ||||

| -$500 (you lost money) |

What debt allows you to do, is to spend all of your money before you've done any of the learning. Even if you somehow got a 0-interest loan on that money, you still have to pay back the principal. You probably think you already know what you need to know, to make a profit. Most likely, though, there are "unknown unknowns" which you don't know, and don't realize you need to know. How do you find them out? By going around that "Loop" of Try-Result-Observe-Plan, but with smaller stakes, so that you don't do all the spending before you've done any of the learning.

Perhaps you know a lot about the business you're about to start, but you haven't actually been a business owner for very long (if at all), so you don't know as much about whatever the least interesting part of your business is. Let's say you're going to start a restaurant: you may know all about cooking, and presentation, and what makes for a great dining experience. You don't (yet) know about hiring, labor laws, how to keep your employees from stealing money from the till, how to legally go about firing an employee who just isn't working out, how to get along with the health inspectors, which kinds of advertising actually works and which just wastes your money, and so forth. Whatever the business, there are a lot of facets of it that you just don't know much about yet. If you make good use of the Try-Result-Observe-Plan loop, you will get better and better about all of this. But you have to give yourself time to do that learning. If you take out a big loan and Try Big, you will get a Big (but not very Good) Result, and all you can Observe is that you now have a huge debt to pay, and not enough money to pay it back with.

There will certainly be cases where it's simply not possible to get a business started without enough capital. But, I have seen far more small businesses go under because of debt, than because of a lack of access to capital. Debt, even if the interest is very low, is a way of spending all your money before you've done any of the learning. The interest that you have to pay as a result of a loan, is just an extra bad thing to go on top of the main problem. Beware of debt.

So, if debt is such a bad idea, why do so many big businesses use it? Well, there are a few things to point out about that.

First, there ARE plenty of big businesses that get into trouble, even wrecked, because of debt, or even because they got "free money". Venture capitalists who swoop in with large amounts of money, that they thrust into the hands of rookie entrepeneurs, can absolutely kill a business that otherwise would have succeeded; it happens a lot in the tech-heavy startup world. Instead of growing gradually, learning how to spend the money well as they go, they spend a lot of money quickly, grow to huge payrolls, then don't know how to maintain that size but try anyway (in order to justify the huge valuations that the venture capitalists pegged them with), and crash.

Second, most of the big companies that are taking on debt, have been doing this longer than you. They have gone around the "Loop" many times, so when they take on debt, they make better use of that money (maybe). Just because they can, doesn't mean you should, especially when new.

Third, the way big businesses are able to negotiate with their creditors, is not much like what your situation is, as a new, small business. You have probably heard the saying: "If you owe the bank $10,000, it's your problem. If you owe the bank $10,000,000, it's the bank's problem." The numbers in that saying get bigger as the decades go by, but the core meaning remains: big businesses have more leverage when dealing with their bank (or whoever loaned them the money) than you will have. Beware of debt, even when it is very low interest debt.

There are a lot of things I have seen small business owners (or independent contractors like myself) be stubborn about. From what clothes to sell in a store, to what programming languages to learn, and everything in between. But, there is really only one thing which a small business should be stubborn about, and that is about being in business.

Even if you are right, the world can stay wrong longer than you can stay in business. The big gorillas, sometimes, can force the market to do what they want. You are not a big gorilla. You must be agile, and move quickly. If that product line isn't selling, and it costs money, drop it. Be open when your customers want to shop, not when you want to shop, and think they should want to shop. If they won't show up at your coffeeshop if you don't have free WiFi, get some free WiFi. You aren't big enough to make the world do what you want. You must, therefore, be flexible.

Essentially, we all carry around a little mental model of how the world works, and how we want it to work. We use these to make our plans, based on what currently is and what we want to see instead. When things aren't working, it means that our mental model is wrong. Adjusting your idea about how the world works, is part of the "Observe" step in the Loop, above.

When my wife opened her store, she thought that having Renaissance Faire clothes amongst all the other kinds of alternative clothes, might work. She could sell them at a better price than the booths at the fair, and you could show up at the fair already in costume. But, it turns out, people want to do their shopping for Ren Fair clothes, at the fair. It's part of what they're doing there. Also, there is more booze at the fair, to loosen up the purse strings. So, she dropped the idea. Don't be stubborn. The point is not "you should have known that wouldn't work", because all kinds of things that seem like they should work, don't, and occasionally something that seems like it shouldn't work, does. The point is, being stubborn means you are refusing to do the "Observe" part of the Loop, which means you go around the loop fewer times. Racing around that loop, which is really (hopefully) a spiral heading upwards, is how you can succeed. Being stubborn, is like standing still instead. Learn from what worked, and what didn't.

Sometimes, of course, a plan needs to be given enough time to work. But, decide in advance how long you think your plan (new product, new sales technique, new layout, new service, new advertising method, etc.) should take to show results. If it doesn't, be willing to Observe that, and change your Plan accordingly.

Conversely, be very stubborn about being in business. There will always be a good excuse for stopping. The businesses that succeed, are stubborn about that.

So, it may seem odd that, in the middle of a blog post giving advice about having your own business, I tell you to beware of advice. But, I'm not saying to reject all advice. Just be aware, that most (not all) of it will be bogus.

Most people who start their own business, do not succeed. Most people, including many who have never started a business, like giving advice and being opinionated about what other people should be doing. Therefore, it stands to reason that most of the people who give you advice, are giving you bad advice.

Even people who are really smart, or who have owned their own business before, are probably giving you bad advice. The best rule of thumb, for when to take the advice of others, is that it should only be if the other person is actually a successful business owner. The problem is, that it may be hard to know who is successful. The reason why, relates to something that doesn't get talked about a lot. Well, not out loud in polite company, anyway.

The dirty little secret of small business (in the U.S., at least, I don't know enough about other economies to say) is that most of them are not making money, and never will. They are spending their way through a business loan, or the owner's spouse is paying the bills, or the owner's parents were rich, or the owner worked at a hotshot tech startup that went public and they are living off the money they made in the IPO, or something. There are absolutely small businesses that actually support their owners, but they are not the majority. So, just because the person talking to you is a business owner, does not actually tell you if they know what they are talking about. They might have been running "in the red" for years, but some other source of money has been making up the difference.

A surprising number of people who have never owned their own business, will also want to give you advice. I'm not sure why this is; it's like if I decided to tell my car mechanic how to fix cars, even though I've never worked on cars myself. But for whatever reason, lots of people will think they know what you should do and not do, but they don't know what they are talking about (literally). So, even if a lot of people say the same thing, it doesn't necessarily mean that it's correct, unless the people saying it are actually successful business owners.

It may be worth listening to ideas from other people, but the only way to really know if that new idea will work, is to take it around The Loop (see above) once, and Observe the results. Therefore, it needs to not be an idea which, if it doesn't work, will put you into bankruptcy. No matter how many people say that it's a good idea to (for example) spend a lot of money on remodeling your storefront, if it doesn't work, it will be Your Mistake, and no one else will help you to recover. Don't assume that advice, because it is frequently given, is likely to be correct.

And, when you see a lot of other small businesses doing something, and you find yourself wondering "why doesn't that work when I do it?", consider the possibility that it isn't really working when they do it, either. They may just have an outside source of money propping them up, in spite of that. If you don't have an outside source of money to prop you up, you have to look at your own results, because you don't have access to their bank accounts to see if it (whatever "it" is in this case) really is working for the other businesses.